Simplifi lets you easily find and track recurring bills and subscriptions so you can cancel what you no longer use. There are instances when recurring bills and subscriptions get out of hand so that even when they're no longer being used, your credit card is still being charged for services. Some recurring expenses are just impractical, especially when trying to save up for something much bigger. Find And Track Recurring Bills And Subscriptions

Your bills are prioritized according to your preference, or you can also follow tips and trends suggested by Simplifi. This way, you won't only avoid missing a bill, but you can also easily plan when each bill can be paid. Simplifi is also a money management and savings app that lets you track all your bills as simple as possible. All transactions are easily searchable with a search bar in case you need to take a closer look at details or in case you want to when and how much you spent. These categories will also show you how much money you spend on each item or per week, every two weeks, or per month. Your income, bills, recurring subscriptions, and other expenses are analyzed to show you a summary of top-spending expenses. Based on these categories, a pie chart is available so you can see where your money goes. Automatically Categorize TransactionsĪll your transactions are categorized into general and specific groups. This way, you can cut down on unnecessary spending and save more money to achieve your financial goal for 2021. Need a projection of how much you'll spend this month if you keep spending at the current rate? Simplifi's Watchlist feature can calculate it for you too. This tool includes interactive graphs to help you track and monitor specific areas of spending. With the Watchlist feature on the mobile app, you can easily monitor your spending on everything from the essential expenses to the occasional splurges.

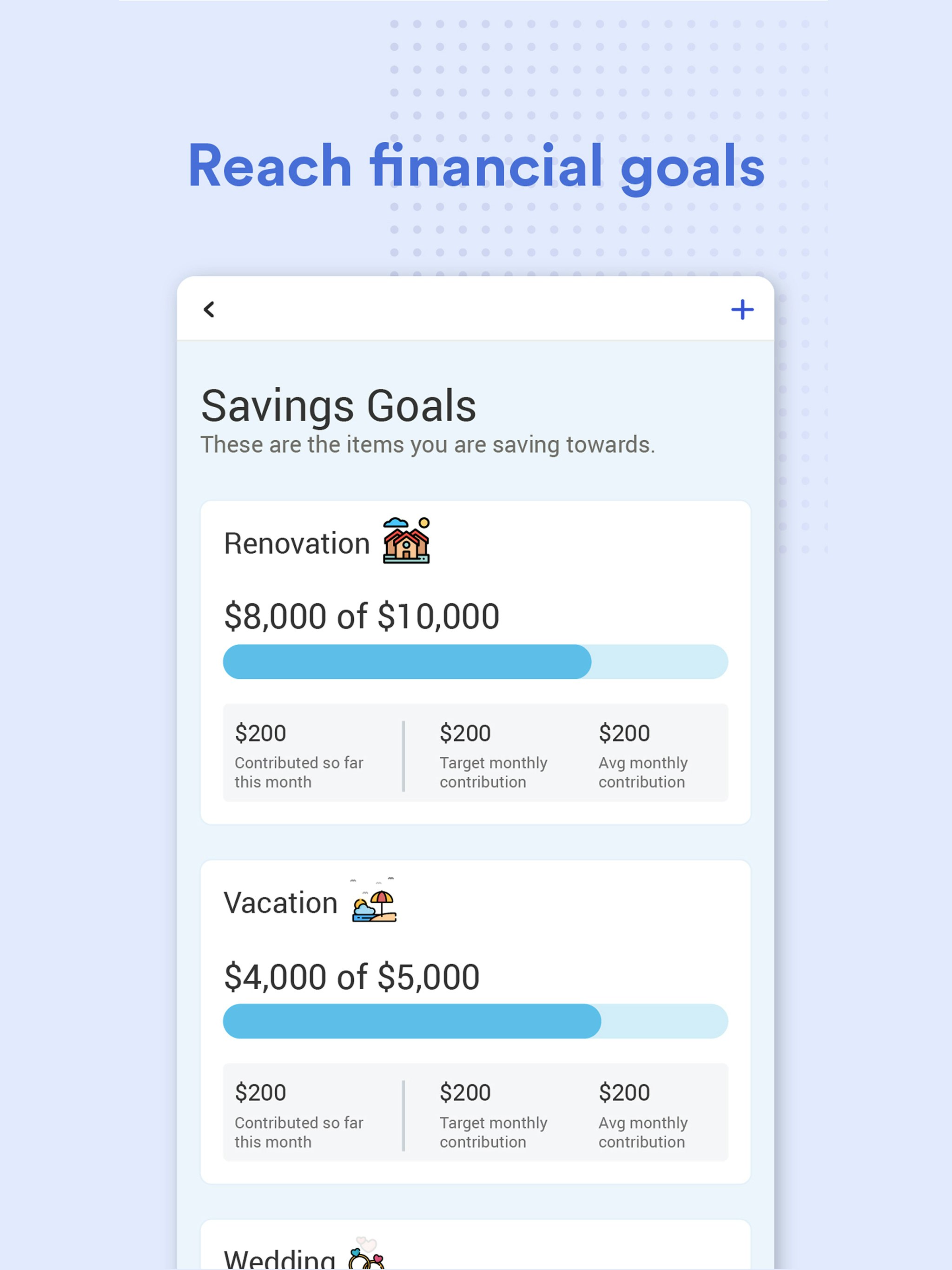

By using Simplifi, you can always review what you have spent so far and see where every last cent of your money goes. When all purchases have been made and all bills have been paid at the end of the day, you may find yourself wondering where all your money has gone. Seeing how much money you have spent so far also raises your awareness of whether the spending limit that you have set for yourself is practical. Strictly follow your spending limits as you get motivated to stick to the amount of spendable income that you have left. Your spending plan inside Simplifi ensures that you are not spending more than you make. As the month goes by, you can see the money you have spent so far and the money you have left to spend for the month, both as a total and as an individual spending plan for each expense. Traveling, shopping, groceries, fitness, and other expenses outside of your bills can be part of your monthly spending plan. Your spending plan can be based on spendable income, which will then be appropriated to the expenses that you input. Create A Spending PlanĬreate a spending plan each month based on what bills and other expenses you pay for. You can also edit your monthly contributions to increase or decrease the amount as you track and see your progress in achieving each milestone. Simplifiallows you to set up savings plans for multiple goals if you are saving for multiple things at the same time, say, a car and a house. Set a target goal date and a monthly contribution to that goal. What are you saving for? Choose between a car, a house renovation, a vacation, or whatever it is you want to save up for. When you have Simplifi, it's like having your own personal accountant. Your bank accounts, loans, credit cards, and investments can all be viewed on Simplifi in a consolidated format that you can easily understand in one glance. See the big picture of your financial standing by looking at everything in one place. View Your Financial Assets, Liabilities, And Investments In One Place 10 Ways Simplifi by Quicken Can Help Achieve Your Money Goals 1.

SIMPLIFI QUICKEN FOR FREE

Try Simplifi for free for 30 days to experience extreme ease in money management. All your income and expenses are laid out in front of you on the app, so all you need to do is to use its other money-saving and money management features. With Simplifi, you'll reach your money goals with a more realistic plan because you get to see the big picture. The New York Times' Wirecutter tagged Simplifi as the Best Budgeting App & Tool because it offers the simplest, most effective approach to managing your money. It's got everything that you need to stay on budget and save as much money as possible. Simplifi by Quicken is a super tool that lets you save money and stick to your financial goals.

0 kommentar(er)

0 kommentar(er)